In response to my “Winning with your home” brief posts on social media, a client asks the following question: “Why does having a little cash in the bank have the single largest impact on getting a good deal?”

It may seem the answer is lengthy and a bit technical, of which I make no apology. However, we believe strongly that our clients are not only great people but highly intelligent. As we walk through the complexity, we will work hard to make it as simple as possible.

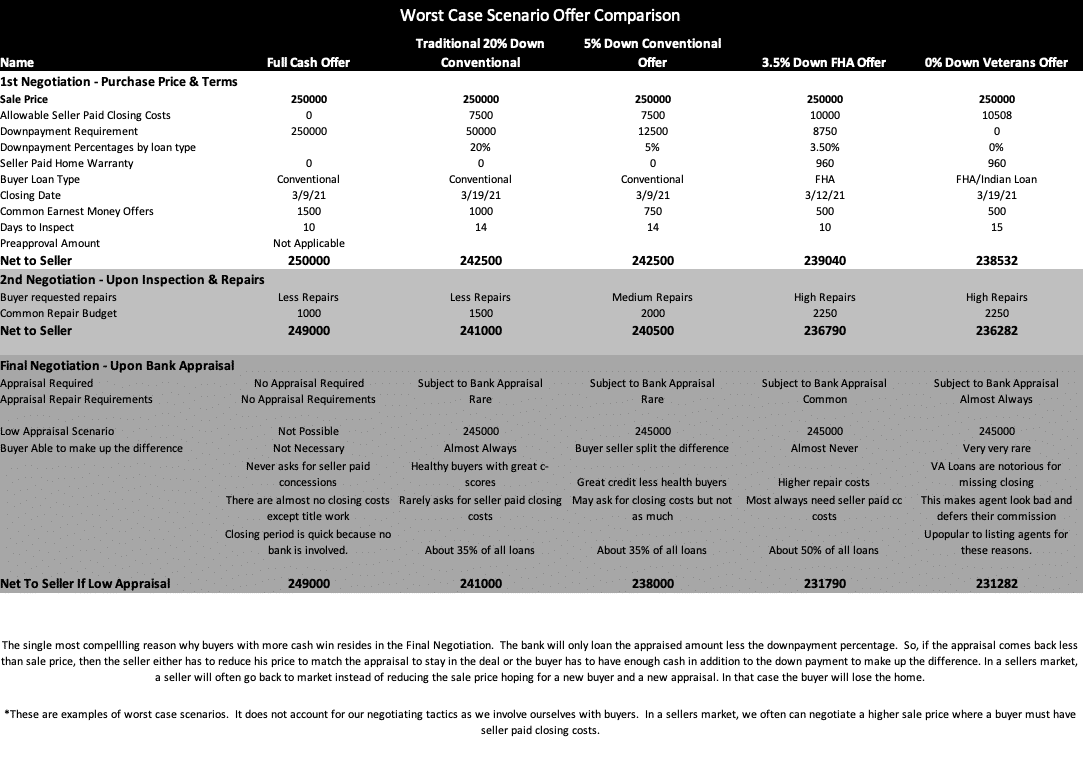

The answer why is found in a buyer putting oneself in the seller’s shoes. At the bottom of this post I put an offer comparison spreadsheet that I present to my sellers who often get multiple offers on their listings. If I were selling your property and we were blessed to have multiple offers I would modify this sheet making a side by side comparison of each offer and their attributes. It educates my sellers on which offer is not only the best financial choice but also the most likely offer to make it across the finish line to closing.

Most deals break on buyers ability to come to closing financially. So an in depth analysis on the largest transaction you make is always important. Many of my counterparts “wing” this and lean on their own experience expecting you to trust them. This usually works out well but I am big on educating you and letting you make the best choice based on data.

In the spreadsheet below, instead of specific examples to a deal, I chose to make common examples of various types of buyers based on their loan types. This really reveals the difference from one buyer to the next. Generally speaking, the amount of cash a buyer has allows them to choose a more favorable loan situation for the seller, often resulting in a higher net to the seller. The more money a seller actually gets to keep from the transaction, the more likely a buyer will win in a multiple offer situation. It is also more likely that a seller will take their property off the market earlier, given they get a buyer they want.

In the spreadsheet, notice that there are three principle negotiations in any real estate transaction. 1st Negotiation is price and terms. The 2nd Negotiation is on repairs. And the Final negotiation is on appraisal.

As you study the offer comparison, it will become apparent that those with more cash cost the seller less. The single most compelling reason why buyers with more cash win resides in whether a buyer can pay their own closing costs and in the Final Negotiation upon appraisal. There are other compelling reasons but the appraisal is the most influential.

Regarding the appraisal, the bank will only loan the appraised amount less the downpayment percentage. So, if the appraisal comes back less than sale price, then the seller either has to reduce his price to match the appraisal to stay in the deal or the buyer has to have enough cash in addition to the down payment to make up the difference. In a sellers market, a seller will often go back to market instead of reducing the sale price hoping for a new buyer and a new appraisal. In that case the buyer will lose the home. Buyers with more cash still win the home in the event that appraisal comes in low. Listing agents know this and advocate for the higher cash laden buyer in the 1st Negotiation, knowing the third negotiation is right around the corner.

There is tons of nuance too. Real Estate agents gun for the most likely buyer to make it to closing, repairs are less with cash laden buyers, cash laden buyers are often less price sensitive, the list goes on. But the appraisal issue is the biggest one.

If you are interested in getting the best deal possible and this article brings up more questions for you, I would love to speak with you. Give us a call. Our contact information is at the bottom of our website and we return all phone calls.

Recent Comments